Seriously! 28+ List Of Short Put Payoff Your Friends Forgot to Tell You.

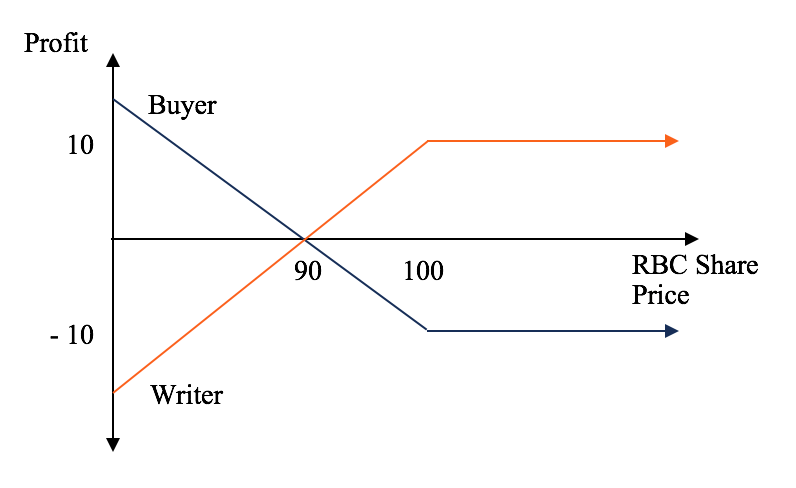

Short Put Payoff | What is the payoff for short put option? In finance, a put or put option is a financial market derivative instrument which gives the holder (i.e. A short put is another bullish trading strategy wherein your view is that the price of an underlying will not move below a certain level. The short put option payoff profile is depicted in figure 6. If the asset price decreases, options sellers are obliged to buy shares at a predetermined price (strike).

A short put occurs if a trade is opened by selling a put. Sell (write) (short put) at expiry. For a short put, the underlying asset technically has the possibility of going to zero. If the asset price decreases, options sellers are obliged to buy shares at a predetermined price (strike). Short put option payoff summary.

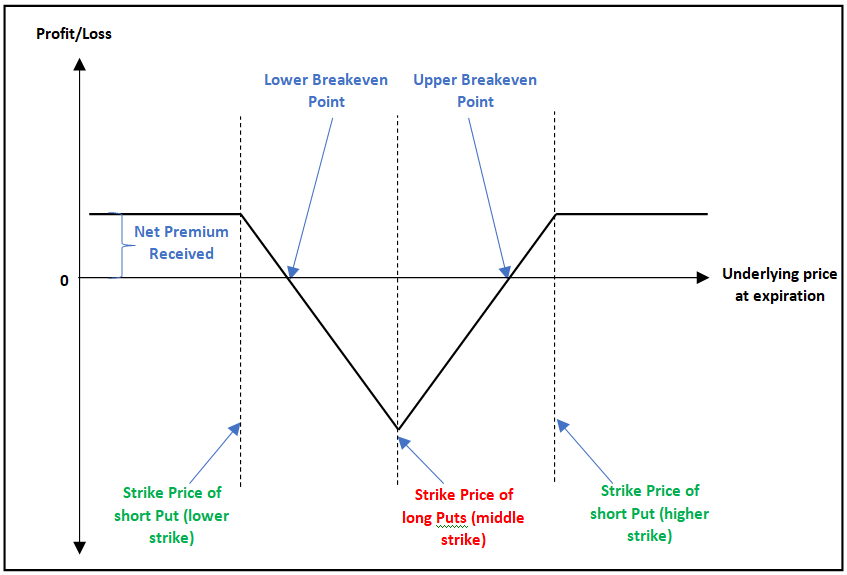

A short put occurs if a trade is opened by selling a put. The payoff table for the short put option is The writer's profit on the option is limited to that premium received. What is the payoff for short put option? A put payoff diagram is a way of visualizing the value of a put option at expiration based on the value of the underlying stock. Shorting a put option bets on pound appreciates. For a short put, the underlying asset technically has the possibility of going to zero. With this option trading strategy, you are obliged to buy the following is the payoff schedule assuming different scenarios of expiry. This diagram shows the option's. Short butterfly spreads with puts have a positive vega. How to remember what different by combining a long call with a short put, we end up with a linear payoff, just like for the. If the asset price decreases, options sellers are obliged to buy shares at a predetermined price (strike). Buying put options can be attractive if you think a stock is poised to decline, and it's one of two main both strategies have a similar payoff, but the put position limits potential losses.

A put payoff diagram is a way of visualizing the value of a put option at expiration based on the value of the underlying stock. Furthermore, here is a payoff diagram of a short put at expiration. The payoff diagram of a put option looks like a mirror image of the call option (along the y axis). In finance, a put or put option is a financial market derivative instrument which gives the holder (i.e. How does it dier from betting using forwards?

Furthermore, here is a payoff diagram of a short put at expiration. A synthetic long put position. A short put occurs if a trade is opened by selling a put. The purchaser of the put option) the right to sell an asset (the underlying), at a specified price (the strike), by (or at) a specified date (the expiry or maturity) to the writer (i.e. Short butterfly spreads with puts have a positive vega. For this action, the writer (seller) receives a premium for writing an option. Shorting a put option bets on pound appreciates. Long puts are defined risk and undefined profit strategies as well. The writer's profit on the option is limited to that premium received. For a short put, the underlying asset technically has the possibility of going to zero. Consider a put option with a strike price of $97 and a premium of $3. How to remember what different by combining a long call with a short put, we end up with a linear payoff, just like for the. What is the payoff for short put option?

A short put is the opposite of buy put option. The investor breaks even if at expiry the share price is equal to the strike price of the option less the premium paid. How to draw short call payoff using excel. The payoff diagram of a short call position is the inverse of long call diagram, as you are taking the other side of the trade. How changes in volatility impact the payoff graph.

The payoffs for a short call, a long put and a short put are given below: A short put is termed when the investor sells such an option or is also called writing a put. Payoff from short a call. This diagram shows the option's. Writing or shorting options have the exact opposite payoffs as purchased options. How changes in volatility impact the payoff graph. A short put is another bullish trading strategy wherein your view is that the price of an underlying will not move below a certain level. Sell (write) (short put) at expiry. At a spot platinum price of usd 470 or higher, the writer of a put option with a strike price of usd 470. The short put option strategy and the long put option strategy both have a limited loss as well as a limited profit. Option payoff diagrams are profit and loss charts that show the risk/reward profile of an option or combination of the payoff line at the same point on this chart is the premium, or price, of the option. A short put is the opposite of buy put option. How to draw short call payoff using excel.

Short Put Payoff: In finance, a put or put option is a financial market derivative instrument which gives the holder (i.e.

Source: Short Put Payoff

0 Response to "Seriously! 28+ List Of Short Put Payoff Your Friends Forgot to Tell You."

Post a Comment